- Specialty chemicals can be single-chemical entities or formulations whose composition sharply influences the performance and processing of the customer’s product.

- This report covers 28 specialty chemical segments categorized either as market-oriented products (used by a specific industry or market, such as electronic chemicals or oil field chemicals) or functional products (groups of products that serve the same function, such as adhesives, antioxidants or biocides).

- There is considerable overlap in this method of characterization. Market-oriented groups often include numerous functional chemicals used by the same market, while functional chemicals typically are used by several different markets.

1] Chemicals (at the end of the day) are commodities. Speciality Chemicals are a sub-segment one could say. So nothing to get excited about this space from a 10/20 year business point of view. The industry might never have sustained high margins.

[2] All chemicals firms pitch them as speciality chemicals. Consider for example PI Industries (I have it in my portfolio by the way); they are into Agri Chemicals, but pitch the firm as Speciality Chemicals.

[3] What exactly are Speciality chemicals? Eg. would be Teflon pans that you use; the chemical coating that goes on it is a speciality chemicals.

[4] Now think about it fundamentally, that if the Teflon coating market is going up. And, there is massive demand for it. Why can’t the other firms copy?

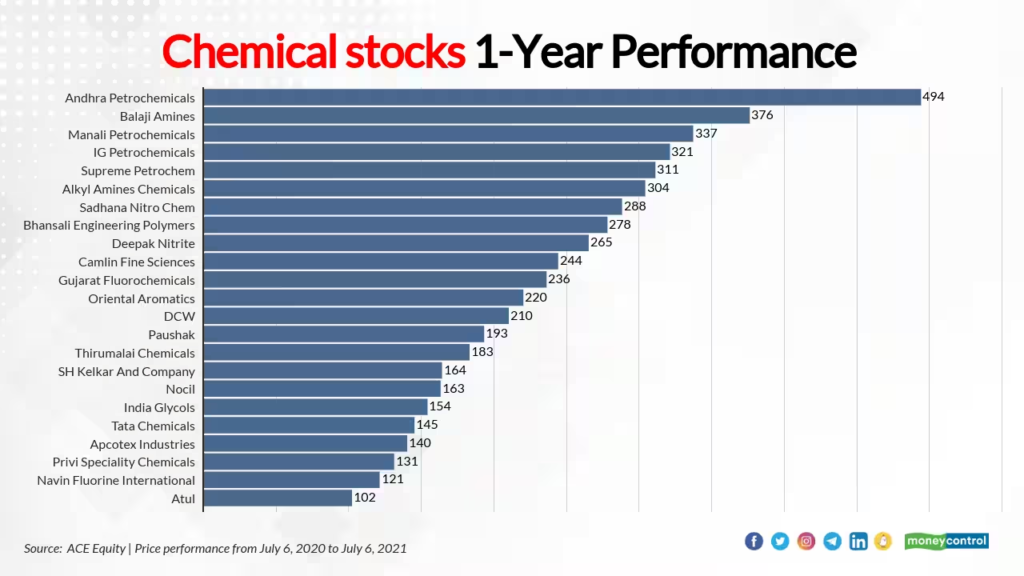

Update on #Chemicals: Just because chemical stocks have fallen 50-60% from their 2021/2022 tops doesn't mean they are going back to new highs in a jiffy. No need to average down unless you are very sure about the business. Markets reward forward rate of change in real earnings…

— Unseen Bio (@unseenvalue) June 4, 2023

[5] They can. Yes, it will take time for them to pump up capacity, build distribution in that niche space etc. But, this can be done. Hence, I say that this is not a sustained advantage.

[6] Now the thing is that in India the manufacturing sector is lagging a bit. And, we are not cost effective for a range of reasons (therefore, a lot of Chinese goods is imported to India)

[7] So the only play for long-term investors is: value play– that if you get these stocks cheap, but and hold. And, try to invest in firms that are segmental leaders in some sub-segment of speciality chemicals.

[8] On that note: I hold PI Industries. Market leader in Agri-Chem (plus entering into Pharma); plus is consolidating for 2 years. So one could argue that it is not expensive.

[9] Another trend that could be played here is the doubling of the market cap play: here Fine Organic is a good candidate. It is a mid cap — positive, business looks sorted. So good chance the market cap in the next 3-5 years should double. Even Tarsons is a good candidate (not necessarily Speciality chem; but more of a specialised manufacturer).

[10] Third play here is timing: the last 1 year was really bad due to China dumping. Speciality Chem with high valuations suffered a lot. Therefore, you will see the trailing 12 months being negative for most speciality chem firms here.

[11] The sentiments now seem to be bouncing back. So from this point, if we pick technically strong candidates, they can give a good 15-20% mid term run-up. On these lines: – Tarsons & Clean Science and Tech (small, but profitable) — can 2X – PI — likely to be a consistent stock – Aarti Industries (debt is high though); but if the results are fine, it should not be a problem. – Deepak Nitrate (valuations are still high) – SRF & Gujarat Flouro (valuation problem as Deepak) – Linde is slow growth; if the industry does not grow fast, you could get stuck for years – BASF (looks interesting, it is too diversified in my opinion; this is both a good/bad thing)