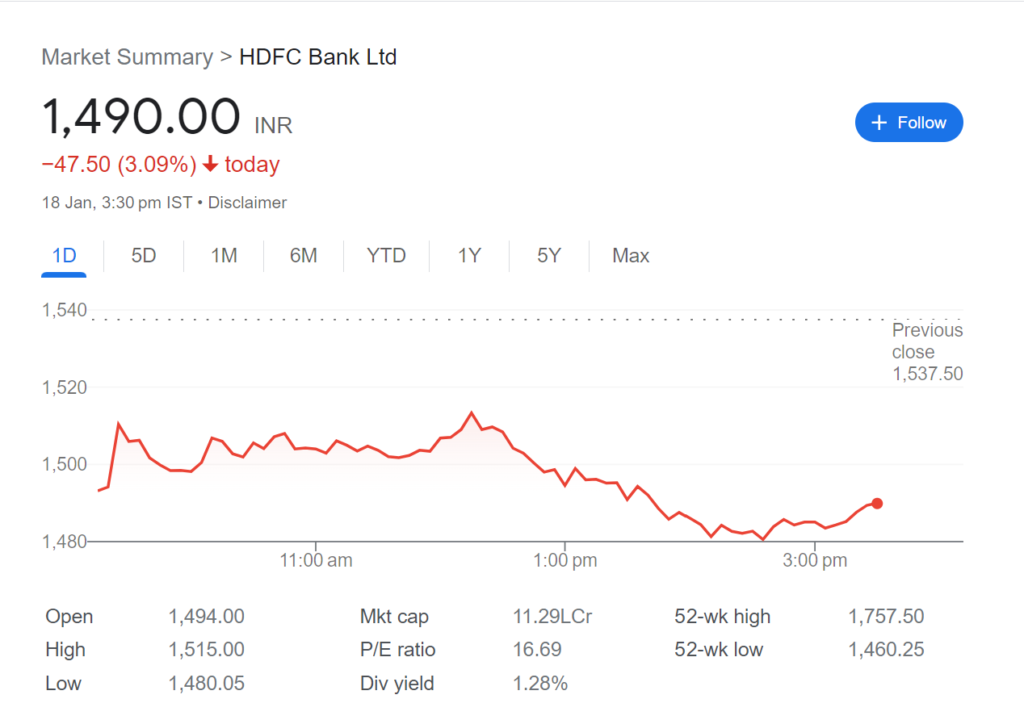

Selling in the market intensified after HDFC Bank’s Q3 earnings disappointed investors. The stock has fallen 11 percent in the last two sessions, with over 3 percent fall on January 18.

Table of Contents

After three days of market fall, Gift Nifty on January 18 traded with gains signalling that benchmark index Nifty could snap its losing streak.

HDFC BANK :

As of 9.06 PM, Gift Nifty added 0.21 percent to 21,516.

The positivity comes after foreign institutional investors (FIIs) sold shares worth Rs 9,901.56 crore, while domestic institutional investors (DIIs) bought Rs 5,977.12 crore worth of stocks on January 18. FIIs had a net worth of Rs 10,578 crore worth of shares on January 17 while DIIs bought shares worth Rs 4,006 crore.

Selling in the market intensified after

Youtube Video :

Hdfc Bank:

Q3 earnings disappointed investors. The stock has fallen 11 percent in the last two sessions, with over 3 percent fall on January 18. The weakness in HDFC Bank shares created a ripple effect on other banking stocks, particularly private sector lenders.

Table About Hdfc :

| Aspect | Details |

|---|---|

| Core Business | Retail Banking, Wholesale Banking, Treasury Operations |

| Founding Year | 1994 |

| Headquarters | Mumbai, India |

| CEO | Aditya Puri (as of my last training cut-off in January 2022; please verify for the latest information) |

| Total Assets (2022) | INR 17.9 trillion |

| Revenue (2022) | INR 1.6 trillion |

| Net Profit (2022) | INR 31,116 crores |

| Number of Branches | 5,608 (as of 2022) |

| Employees | Over 1,17,000 (as of 2022) |

| Customer Base | Over 75 million (as of 2022) |

| Key Services | Retail and Corporate Banking, Loans, Cards, Investment Banking, Asset Management, Insurance, Treasury Services |

| Market Presence | Widely spread across India with a growing international presence. |

| Digital Initiatives | Strong emphasis on digital banking; widely used mobile and online banking platforms. |

| Key Competitors | ICICI Bank, State Bank of India, Axis Bank, Kotak Mahindra Bank |

| Regulatory Compliance | Subject to regulations by the Reserve Bank of India (RBI) and other financial regulatory bodies. |

| Awards and Recognition | Regularly recognized for excellence in banking and financial services. |

| Financial Stability | Historically stable with consistent growth in assets and profits. |

| Community Initiatives | Active in various social responsibility programs and community development projects. |

Entry level Salary offered by IT firms in 2003-04: around 2.5-3Lakhs.

— Akshat Shrivastava (@Akshat_World) September 22, 2022

Entry level Salary in 2022: around 3-3.5Lakhs.

Inflation every year around 5-6%.

So a salary of 2.5Lakhs should have been around 6.5-7 Lakhs now.

Pay people better, they won't moonlight or leave.